Using this contribution margin format makes it easy to see the impact of changing sales volume on operating income. Fixed costs remained unchanged; however, as more units are produced and sold, more of the per-unit sales price is available to contribute to the company’s net income. In our example, the sales revenue from one shirt is \(\$15\) and the variable cost of one shirt is \(\$10\), so the individual contribution margin is \(\$5\).

Comparing Gross Margin and Profit Margin

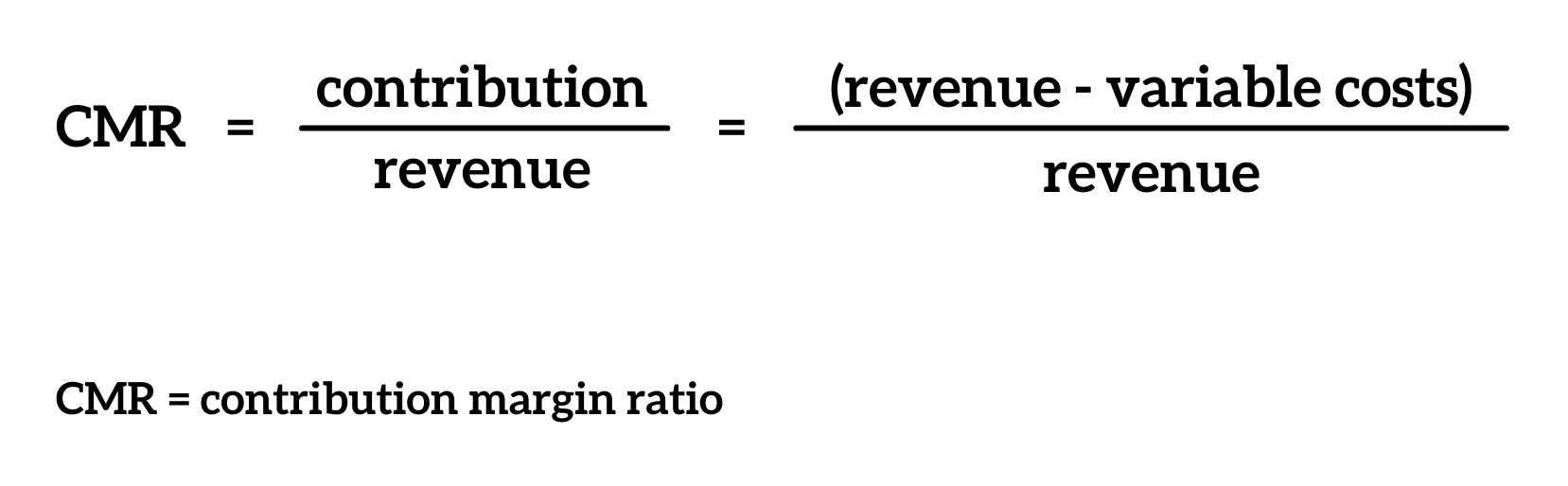

Contribution margin ratio is equal to contribution margin divided by sales. You need to fill in the following inputs to calculate the contribution margin using this calculator. The Contribution Margin Calculator is an online tool that allows you to calculate contribution margin. You can use the contribution margin calculator using either actual units sold or the projected units to be sold.

The Difference Between Contribution Margin and Gross Margin

This is crucial for a business to understand because it helps them see which products are really making money and which might be losing money. It shows the percentage of sales revenue that ends up as profit after all expenses are paid. This includes every cost, from making the product to the company’s rent and advertising. It’s a critical number because it tells you if the company’s actually making money or if it’s losing money. Net profit margin is a key part of bookkeeping and helps everyone from the manager to investors understand how well the company is doing. The basic difference between a traditional income statement and a contribution margin income statement lies in the treatment of variable and fixed expenses for a period.

What is the Contribution Margin Ratio?

This ratio amplifies the insights of the contribution margin by contextualizing them concerning sales. Next, the CM ratio can be calculated by dividing the amount from the prior step by the price per unit. The 60% CM ratio implies the contribution margin for each dollar of revenue generated is $0.60. The insights derived post-analysis can determine the optimal pricing per product based on the implied incremental impact that each potential adjustment could have on its growth profile and profitability. If the contribution margin is too low, the current price point may need to be reconsidered. In such cases, the price of the product should be adjusted for the offering to be economically viable.

Going back to that beauty company example from earlier, we’ll assume the business has expanded into the high-end skincare market and wants to see how the new line is performing financially. My Accounting Course is a world-class educational resource developed by experts to simplify accounting, finance, & investment analysis topics, so students and professionals can learn and propel their careers. Managerial accountants also use the contribution margin ratio to calculate break-even points in the break-even analysis. Management should also use different variations of the CM formula to analyze departments and product lines on a trending basis like the following. To illustrate the concepts of contribution margin, consider the following example.

- Fixed costs are costs that may change over time, but they are not related to the output levels.

- If they sold 250 shirts, again assuming an individual variable cost per shirt of $10, then the total variable costs would $2,500 (250 × $10).

- Further, it is impossible for you to determine the number of units that you must sell to cover all your costs or generate profit.

- Next, the CM ratio can be calculated by dividing the amount from the prior step by the price per unit.

We would consider the relevant range to be between one and eight passengers, and the fixed cost in this range would be $200. If they exceed the initial relevant range, the fixed costs would increase to $400 for nine to sixteen passengers. Thus, the concept of contribution margin is used to determine the minimum price at which you should sell your goods or services to cover its costs. Therefore, it is not advised to continue selling your product if your contribution margin ratio is too low or negative.

You’ll notice that the above statement doesn’t include the contribution margin. That’s because a contribution margin statement is generally done separately from the overall company income statement. EBIT features in a company income statement as it gives the operating figures of a business more context. The contribution margin provides the profitability of each individual dish at a restaurant, whereas income would look at the entire restaurant’s overall financial health. Getting this calculation right can be time-consuming and relies on consistent reporting for fixed and variable earnings.

The information provided on this website does not, and is not intended to, constitute legal, tax or accounting advice or recommendations. All information prepared on this site is for informational purposes only, and should not be relied on for legal, tax or accounting advice. You should consult your own legal, tax or accounting advisors before engaging in any transaction. The content on this website is provided “as is;” no representations are made that the content is error-free. Implement our API within your platform to provide your clients with accounting services.

A contribution margin is a narrow view of a product or service’s profitability, but the net profit is a much wider and more comprehensive look at a company’s financial performance. If we subtract the variable costs from the revenue, we’re left with a $22,000 contribution margin. The contribution margin ratio is also known as the profit volume ratio. This is because it indicates the rate of profitability of your business. Prepare a traditional income statement and a contribution margin income statement for Alta Production.

To illustrate how this form of income statement can be used, contribution margin income statements for Hicks Manufacturing are shown for the months of April and May. The formula to calculate the contribution margin is equal to revenue minus variable costs. The Contribution Margin is the incremental profit earned on each unit of product sold, calculated by subtracting direct variable costs from revenue. The contribution margin represents the revenue that a company gains by selling each additional unit of a product or good.

Since machine and software costs are often depreciated or amortized, these costs tend to be the same or fixed, no matter the level of activity within a given relevant range. Similarly, we can then calculate the variable cost per unit by dividing the total variable costs by the number of products sold. Contribution margin income statements refer to risk response plan the statement which shows the amount of contribution arrived after deducting all the expenses that are variable from the total revenue amount. Then, further fixed expenses are deducted from the contribution to get the net profit/loss of the business entity. The concept of this equation relies on the difference between fixed and variable costs.