However, to reduce cost, the dollar amounts are only determined using a periodic system at the end of the year to prepare financial statements. In that way, the company gains valuable information (the number of units on hand) at a reduced amount. Record the purchase discount by debiting the accounts payable account and crediting the purchase discount account. The main benefits of employing a periodic inventory system are the ease of implementation, its lower cost and the decrease in staffing needed to run it.

Comprehensive Guide to Inventory Accounting

In a perpetual inventory system, the maintenance of a separate subsidiary ledger showing data about the individual items on hand is essential. However, the company also needs specific information as to the quantity, type, and location of all televisions, cameras, computers, and the like that make up this sum. That is the significance of a perpetual system; it provides the ability to keep track of the various types of merchandise.

Adjusting and Closing Entries for a Perpetual Inventory System

A periodic inventory system uses a different accounting procedure than other systems like perpetual inventory. A temporary account for purchases in a periodic system serves as the foundation for inventory accounting. There are some key differences between perpetual and periodic inventory systems. When a company uses the perpetual inventory system and makes a purchase, they will automatically update the Merchandise Inventory account. Under a periodic inventory system, Purchases will be updated, while Merchandise Inventory will remain unchanged until the company counts and verifies its inventory balance. This count and verification typically occur at the end of the annual accounting period, which is often on December 31 of the year.

Perpetual LIFO

- Under periodic inventory procedure, the Merchandise Inventory account is updated periodically after a physical count has been made.

- The products in the ending inventory are either leftover from the beginning inventory or those the company purchased earlier in the period.

- Accountants do not update the general ledger account inventory when their company purchases goods to be resold.

- That’s why businesses with high sales volume and multiple sales channels use a perpetual inventory system, instead.

- A Periodic Inventory System is a way for businesses to track their inventory by counting it at specific intervals, like at the end of a month, quarter, or year, rather than keeping a running tally every day.

- On May 21, we paid with cash so we do not have credit terms since it has been paid.

Between the two accounting systems, there are differences in how you update the accounts and which accounts you need. In a perpetual system, the software is continuously updating the general ledger when there are changes to the inventory. In the periodic system, the software only updates the general ledger when you enter data after taking a physical count. In a perpetual system, the COGS account is current after each sale, even between the traditional accounting periods. In the periodic system, you only perform the COGS during the accounting period.

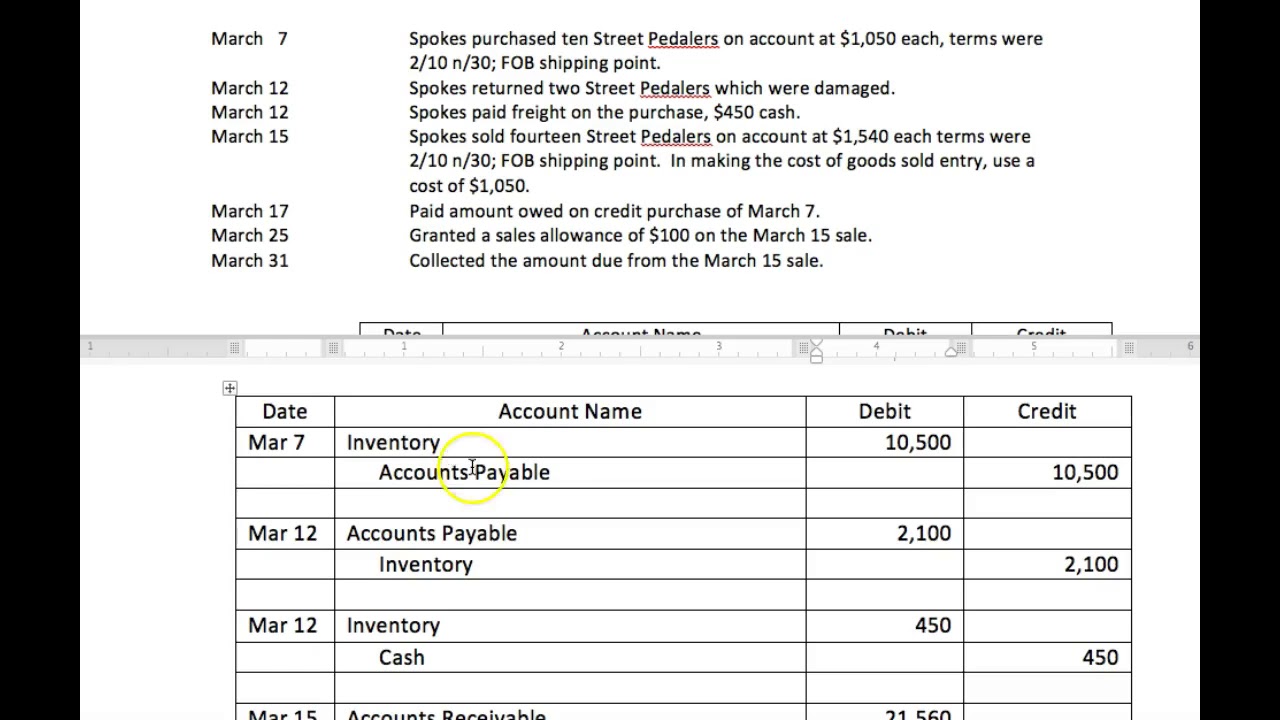

Settlement of Accounts Payable

There are advantages and disadvantages to both the perpetual and periodic inventory systems. As you can see, weighted average in a periodic system is a calculation done outside of the ledger. In this method, you calculate an average for the period instead of moving transactions over when the company bought or sold something during the period. Weighted average cost (WAC) in a periodic system is another cost flow assumption and uses an average to assign the ending inventory value. Using WAC assumes you value the inventory in stock somewhere between the oldest and newest products purchased or manufactured. Record sales discount by debiting the sales discount account and crediting the accounts receivable account.

Periodic FIFO

The adjusting entry is based on the formula to calculate the cost of goods sold. Thus, the purchases and merchandise inventory (beginning) are added together and represent goods available for sale. Therefore, before any adjusting entries, the balance in the merchandise inventory account will reflect the amount of inventory at the beginning of the year, as indicated in the following T-accounts. The transaction will record inventory based on the month-end physical count. At the same time, we need to reverse last month’s inventory balance otherwise it will double count. Perhaps, most importantly, some companies often use a hybrid system where the units on hand and sold are monitored with a perpetual system.

Our custom OMS can help in tasks such as automatic tracking and updating of inventory in real-time, across fulfillment centers and selling platforms, inventory management and a wide range of other services. The physical count of each item in the inventory is then used to establish the ending inventory. Finally, you can calculate the cost of the ending or closing inventory benefits for the terminally ill using the weighted average price, first in, first out, or last in, first out. In rare circumstances, the business can substitute the beginning inventory for the ending or remaining balance of inventory from the prior accounting period. While each inventory system has its own advantages and disadvantages, the more popular system is the perpetual inventory system.

However, perpetual systems require your staff to perform regular recordkeeping. For example, in a periodic system, when you receive a new pallet of goods, you may not count them and enter them into stock until the next physical count. In a perpetual system, you immediately enter the new pallet in the software so the system can track its life in your business. When there is a loss, theft or breakage, you should also immediately record these updates. Any business can use a periodic system since there’s no need for additional equipment or coding to operate it, and therefore it costs less to implement and maintain. Further, you can train staff to provide simple inventory counts when time is limited or you have high staff turnover.

The counting and tracking may be done either monthly, quarterly or annually and helps in keeping a steady and continuous record of the quantity of inventory with the company. It also increases the accounts receivable and cash based on the nature of the sale. Regardless of the system, Rider holds one piece of inventory with a cost of $260. The decision as to whether to utilize a perpetual or periodic system is based on the added cost of the perpetual system and the difference in the information generated for use by company officials.

The periodic inventory approach is primarily used by small businesses that deal with very few transactions, or companies that only have a limited number of inventory. When merchandise is sold, an entry is made to record the sales revenue, but none to record the cost of goods sold, or to reduce the inventory. Consequently, there are no merchandise inventory account entries during the period. A simplified form of the above journal entry uses a single debit or credit to inventory account by calculating the difference of ending inventory and beginning inventory.