Purchases are offset by Purchase Discounts, and also Purchase Returns and Allowances. When purchases should be added to inventory depends on the Free On Board (FOB) policy of the trade. For the purchaser, this new inventory is added on shipment (and the seller removes the item from inventory when it is shipped by the seller) if the policy was FOB shipping point. Read each section in this chapter, which explains the purpose of the balance sheet, income statement, and the cash flow statement. It also is a guide to where you will find financials on publicly traded companies. You should get as much practice working on these statements as you can, since they are the fundamental information on any organization.

How confident are you in your long term financial plan?

This additional layer of complexity can increase the administrative burden and the risk of errors in tax reporting. The return of goods from customers to seller also involves two journal entries – one to record the sales returns and allowances and one to reverse the transfer of cost from inventory to COGS account. Net method of cash discount is the accounting method in which sales are accounted for assuming the cash discount will be availed by the customer. Sales under this method are thus not recorded at the full invoice value but at the reduced value after considering the effect of cash discount.

What are some benefits of using net method of recording purchase discounts?

This method contrasts with the gross price method, where purchases are initially recorded at their gross price and a purchase discount is only recorded if payment is made within the discount period. We learned that shipping terms tell you who is responsible for paying for shipping. Free on board (FOB) destination means the seller is responsible for paying shipping and the buyer would not need to pay or record anything for shipping. Free on board (FOB) shipping point means the buyer is responsible for shipping and must pay and record for shipping. In the accounting department, you have matched up the receiving documents sent with this invoice and it is now ready to be paid.

- This proactive recording ensures that the financial statements reflect the most accurate and realistic figures.

- Ultimately, it’s up to you to decide which one makes the most sense for your business.

- However, the amount of the entry is for the invoice amount of the purchase, less the anticipated discount.

- The net method of accounting can significantly influence a company’s financial statements, offering a more precise representation of its financial health.

Journal Entries to Record Purchase Discounts Under Net Method

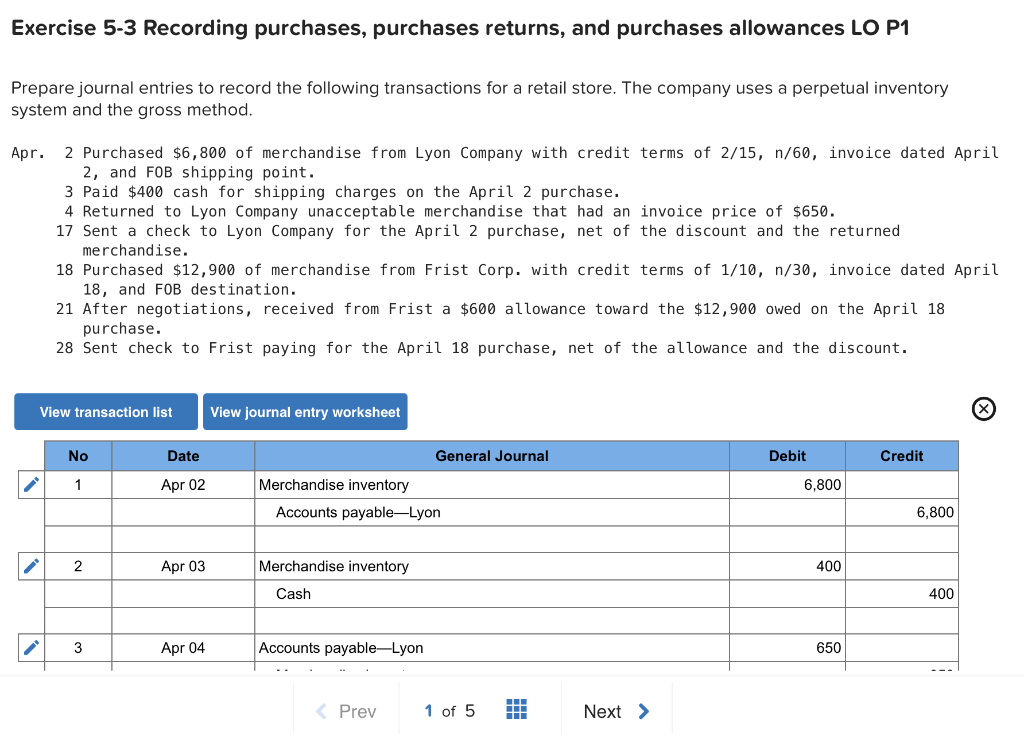

Under perpetual inventory system, the expenses that are incurred to obtain merchandise inventory are added to the cost of merchandise available for sale. These expenses are, therefore, also debited to inventory account under this system. The general examples of such expenses include freight-in and insurances expense etc. Each time the merchandise is sold, the related cost is transferred from inventory account to cost of goods sold account by debiting cost of goods sold and crediting inventory account. The gross method, by not factoring in discounts upfront, may portray a business as having higher initial revenues and expenses.

Understanding its concepts, calculations, and applications is essential for businesses aiming to optimize their financial reporting practices. If the invoice is paid within the first ten days, Big Guitar, LLC would be able to record the payoff at the discounted price. Furthermore, the use of the account, Purchase Discounts Lost; highlights the total cost of not paying within the discount period. Importantly, storage costs, insurance, interest and other similar costs are considered to be period costs that are not attached to the product. Instead, those ongoing costs are simply expensed in the period incurred as operating expenses of the business. Take a moment and look at the invoice presented earlier in this chapter for Barber Shop Supply.

What is the Net Method of Recording Accounts Payable?

By recording transactions at their net value, the need for subsequent adjustments is minimized, reducing the complexity of financial reporting. This can be beneficial for businesses with high transaction volumes, where the administrative burden of tracking and adjusting for discounts can be substantial. Software solutions like QuickBooks and Xero can automate this process, ensuring accuracy and efficiency in financial reporting. The beginning inventory is equal to the prior year’s ending inventory, as determined by reference to the prior year’s ending balance sheet.

When employing the net method, calculating discounts becomes an integral part of the initial transaction recording. This approach requires businesses to anticipate the discount at the time of purchase or sale, rather than waiting until the payment is made. For example, if a company purchases goods worth $10,000 with a 2% discount for early payment, the transaction is recorded at $9,800. This proactive recording how to pay taxes as a freelancer ensures that the financial statements reflect the most accurate and realistic figures. Perpetual inventory system is a technique of maintaining inventory records that provides a running balance of cost of goods available for sale and cost of goods sold for a period. Under this system, no purchases account is maintained because inventory account is directly debited with each purchase of merchandise.

FOB specifies which party (buyer or seller) pays for which shipment and loading costs and where responsibility for the goods is transferred. The last distinction is important for determining liability for goods lost or damaged in transit from the seller to the buyer. International shipments typically use “FOB” as defined by the Incoterm standards, where it always stands for “Free On Board”. Or Canada often use a different meaning, specific to North America, which is inconsistent with the Incoterm standards.

This method also necessitates a keen understanding of the timing of transactions. Since the net method assumes the discount will be taken, businesses must be diligent in making timely payments to realize the anticipated savings. Failure to do so would require adjustments, which can complicate financial records.

Even if a merchant is selling goods at a healthy profit, financial difficulties can creep up if a large part of the inventory remains unsold for a long period of time. Therefore, a prudent business manager will pay very close attention to inventory content and level. There are many detailed accounting issues that pertain to inventory, and a separate chapter is devoted exclusively to inventory issues. This chapter’s introduction is brief, focusing on elements of measurement that are unique to the merchant’s accounting for the basic cost of goods.

The net price method, also known as the net method, is an accounting technique used to record purchases and discounts. Under this method, purchases are recorded at their net price, which is equal to the gross price (the original price) minus any purchase discounts available. Before we dive into the COGS details for the periodic system, begin to familiarize yourself with this chart. This is a quick way to compare the differences between how the two methods record the details involved with inventory. Notice that we did not post the purchases to the inventory account, which is a major difference between this periodic system and the perpetual system.