Let’s explore each entry in more detail using Printing Plus’sinformation from Analyzing and Recording Transactions and The Adjustment Process as our example. The Printing Plusadjusted trial balance for January 31, 2019, is presented inFigure 5.4. State whether each account is apermanent or temporary account. It is the end of the year,December 31, 2018, and you are reviewing your financials for theentire year. You see that you earned $120,000 this year in revenueand had expenses for rent, electricity, cable, internet, gas, andfood that totaled $70,000. Notice that the balance of the Income Summary account is actually the net income for the period.

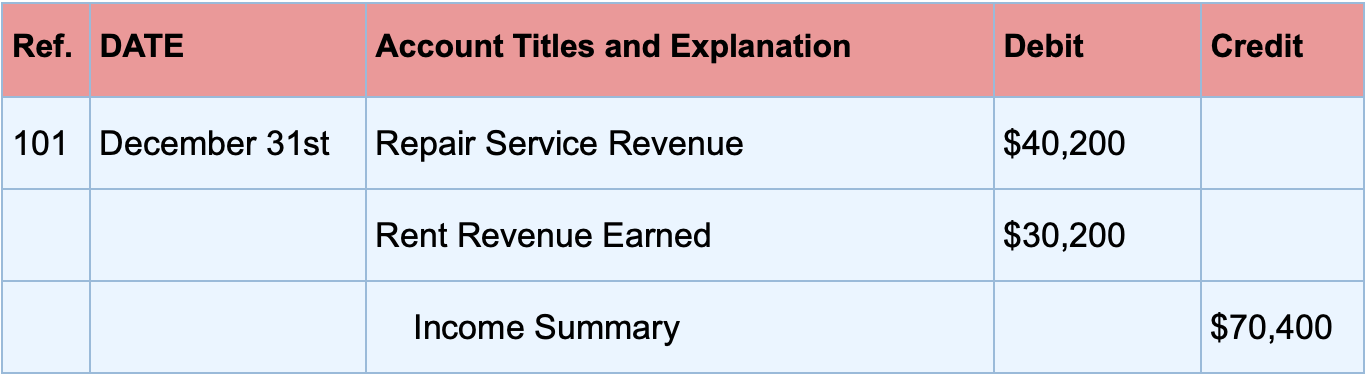

Recording a Closing Entry

The closing entries are the last journal entries that get posted to the ledger. After preparing the closing entries above, Service Revenue will now be zero. The expense accounts and withdrawal account will now also be zero. Let’s say your business wants to create month-end closing entries. During the accounting period, you earned $5,000 in revenue and had $2,500 in expenses.

Frasker Corp. Closing Entries

You must close each account; you cannot just do an entry to “expenses”. You can, however, close all the expense accounts in one entry. If the balances in the expense accounts are debits, how do you bring the balances to zero? The debit to income summary should agree to total expenses on the Income Statement.

Do you already work with a financial advisor?

Temporary accounts will have a zero balance after closing entries are made. They are special entries posted at the end of an accounting period. Prepare the closing entries for Frasker Corp. using the adjustedtrial balance provided. Printing Plus has a $4,665 credit balance in its Income Summaryaccount before closing, so it will debit Income Summary and creditRetained Earnings. Thebusiness has been operating for several years but does not have theresources for accounting software. This means you are preparing allsteps in the accounting cycle by hand.

- In this guide, we delve into what closing entries are, including examples, the process of journalizing and posting them, and their significance in financial management.

- In contrast, temporary accounts capture transactions and activities for a specific period and require resetting to zero with closing entries.

- Now Paul must close the income summary account to retained earnings in the next step of the closing entries.

- This crucial step ensures that financial records are accurate and up-to-date for the next period, making it easier to track the company’s performance over time.

- Imagine you own a bakery business, and you’re starting a new financial year on March 1st.

Get in Touch With a Financial Advisor

However, you might wonder, where are the revenue, expense, and dividend accounts? Trial balances often filter out accounts with zero balances. These accounts were reset to zero at the end of the previous year to start afresh. On expanding the view of the opening trial balance snapshot, we can view them as temporary accounts, as can be seen in the snapshot below. Each of these accounts must be zeroed out so that on the first day of the year, we can start tracking these balances for the new fiscal year.

Remember that net income is equal to all income minus all expenses. Debit the Income Summary account and credit each expense account. Notice that the Income Summary account is now zero and is readyfor use in the next period. The Retained Earnings account balanceis currently a credit of $4,665. LiveCube Task Automation is designed to automate repetitive tasks, improve efficiency, and facilitate real-time collaboration across teams. By leveraging advanced workflow management, the no-code platform, LiveCube ensures that all closing tasks are completed on time and accurately, reducing the manual effort and the risk of errors.

As you will learn in Corporation Accounting, there are three components to thedeclaration and payment of dividends. The first part is the date ofdeclaration, which creates the obligation or liability to pay thedividend. The second part xero is the date of record that determines whoreceives the dividends, and the third part is the date of payment,which is the date that payments are made. Printing Plus has $100 ofdividends with a debit balance on the adjusted trial balance.

Closing entries are a fundamental part of accounting, essential for resetting temporary accounts and ensuring accurate financial records for the next period. This process highlights a company’s financial performance and position. In this guide, we delve into what closing entries are, including examples, the process of journalizing and posting them, and their significance in financial management. When doing closing entries, try to remember why you are doing them and connect them to the financial statements.

We could do this, but by having the Income Summaryaccount, you get a balance for net income a second time. This givesyou the balance to compare to the income statement, and allows youto double check that all income statement accounts are closed andhave correct amounts. If you put the revenues and expenses directlyinto retained earnings, you will not see that check figure. Nomatter which way you choose to close, the same final balance is inretained earnings. To further clarify this concept, balances are closed to assureall revenues and expenses are recorded in the proper period andthen start over the following period.