Raw materials for the manufacturing of products cost ₹50,000 for the company. For those willing to put in some effort, leading brokers in ETF investing provide screeners. These tools enable you to sift through the fund landscape, identifying high-performing, low-cost options. Simply specify your criteria, and the screener will highlight the top picks. Now that we know how expense ratio is calculated, let’s see how TERs work. Your costs might be spiraling out of control, or you’re not selling enough to cover them.

- As far as passively managed funds, index funds are a popular option among investors since they track a specific stock index and aim to match its rate of return.

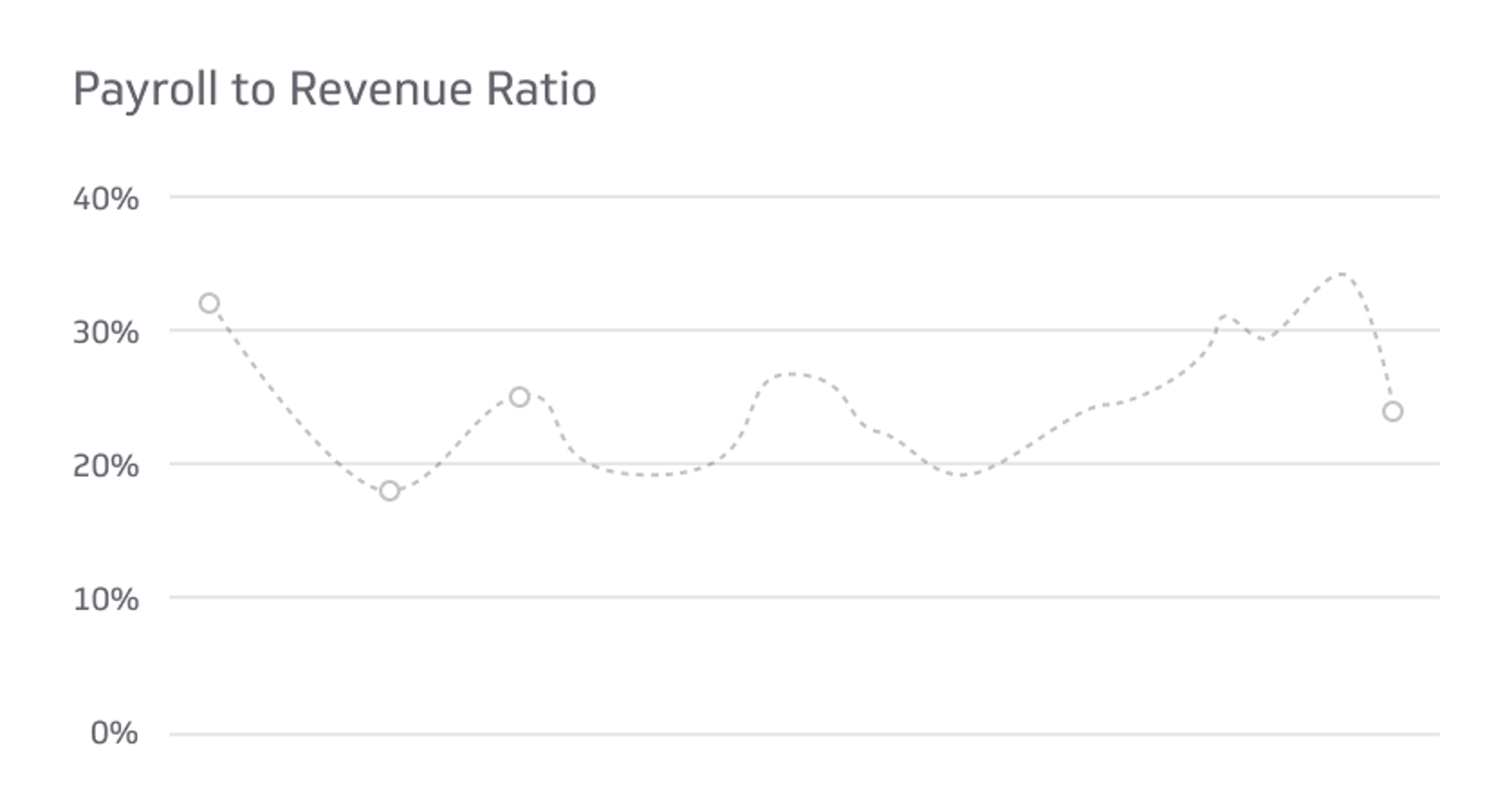

- By keeping a close eye on this ratio, businesses can identify areas where costs can be reduced, revenue can be increased, and overall financial performance can be enhanced.

- Financial ratios can help you compare one company’s financial results to another or track the performance of a single company over time.

- We do not include the universe of companies or financial offers that may be available to you.

What Can Profitability Ratios Tell You?

In contrast, a smaller fund may have to charge more to break even but may reduce its expense ratio to a competitive level as it grows. The asset-weighted average on stock index mutual funds, which are passively managed, fell from 0.27 percent in 2000 to just 0.05 percent in 2023. These funds are popular options in employer-sponsored 401(k) plans, and they’re cost-competitive with passively managed ETFs. Typically, any expense ratio higher than 1 percent is high and should be avoided. Over an investing career, a low expense ratio could easily save you tens of thousands of dollars, if not more.

Assessing Inventory Turnover Ratio

By tracking these KPIs, businesses can gain a comprehensive understanding of their expense-to-revenue ratio and make informed decisions to improve profitability. Remember, evaluating ROI is essential for businesses to make informed financial decisions and assess the effectiveness of their investments. By considering different perspectives and utilizing appropriate analysis techniques, businesses can gain valuable insights into their financial performance.

How to Evaluate Total Expense Ratios?

Expense ratios play a crucial role in assessing the financial health and efficiency of a business. They provide valuable insights into the allocation and utilization of resources within an organization. In this section, we will delve into the intricacies of expense ratios, exploring their calculation methods and interpreting their significance. A company’s operating margin equals operating income divided by net sales. This is used to show how much revenue is left over after paying variable costs such as wages and raw materials. It is the same as the company’s return on sales, and indicates how well that return is being managed.

The operating expense ratio measures a company’s operating expenses as a percentage of its net sales. This key financial metric provides insight into a company’s operational efficiency and profitability. Other lessor versus lessee costs included in a fund’s expense ratio are taxes, legal fees, accounting, auditing and recordkeeping. While operating expenses can vary for mutual funds, the expense ratio tends to be relatively stable.

You can improve your cost to revenue ratio and enjoy profits by reducing costs and increasing revenue. Adopting new tech not only directly lowers overhead, but also enables businesses to scale without proportionally increasing operating expenses. The income statement is one of the four primary financial statements companies issue. The income statement shows gross sales revenue at the top, followed by various categories of expenses that are itemized and deducted, resulting in net income, or the bottom line. CRR is a multifaceted metric demanding a comprehensive grasp of expenses and income. It extends beyond a basic formula – considering nuances like timing intricacies, concealed expenditures, and the relationship between cost management and revenue expansion.

The use of the term “return” in the ROA measure customarily refers to net profit or net income—the value of earnings from sales after all costs, expenses, and taxes. Cash flow margin is a significant ratio for companies because cash is used to buy assets and pay expenses. A greater cash flow margin indicates a greater amount of cash that can be used to pay, for example, shareholder dividends, vendors, and debt payments, or to purchase capital assets.

A high expense to revenue ratio can be a warning sign of financial distress. It suggests that a company is spending more money than it is generating in revenue, potentially leading to unsustainable financial conditions. From the perspective of business owners, a low operating expense ratio indicates that the company is operating efficiently and keeping its costs under control. On the other hand, a high operating expense ratio may suggest that the company is spending too much on its operations, which can negatively impact profitability. A fund’s trading activity—the buying and selling of portfolio securities—is not included in its calculation of the expense ratio. Costs not included in operating expenses are loads, contingent deferred sales charges (CDSC), and redemption fees, which, if applicable, are paid directly by fund investors.